Predict GDP growth

predict at economic boom & bust, a quantile regression + random forest method

Advisor: Dr. Seunghwa Rho

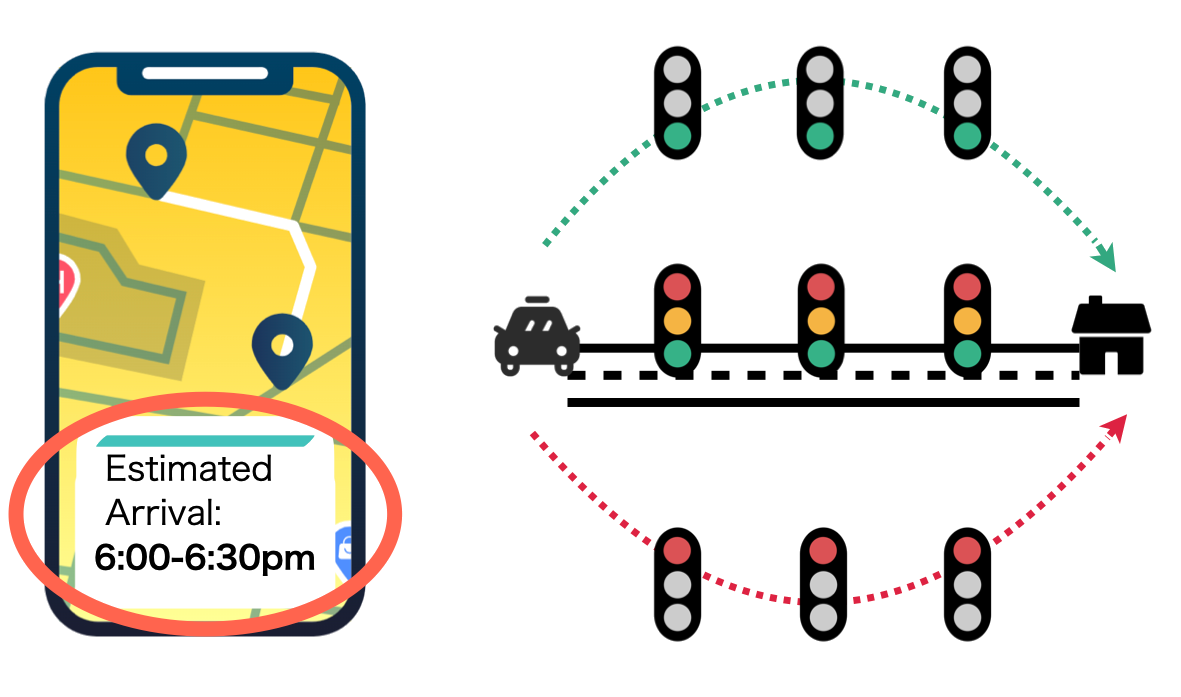

Imagine you ordered a takeout on your phone, and it says your food will arrive between 6:00-6:30. Why exactly does it gives an interval rather than just a specific time? This is because when the traffic is bad, the driver might take more time to deliver the food and less time if there’s all green light!

This is a simple example of “quantile regression” in real life - predict at different situations. In this project, I analyzed the relationship between GDP growth and economic and financial conditions across quantiles by applying quantile regression and tree based methods.

The ability to forecast GDP growth is important because it indicates the general health of the economy and helps policymakers make decisions. Mostly, economists focus on point estimates for conditional mean of GDP growth along with other economic variables, which can overly generalize the information given by the data. It is of equal interest for us to understand the relationship between independent variables and a dependent variable at different quantiles, i.e. the behaviors of economies at different economic conditions.

The thesis is published at Emory Theses and Dissertations Repo, and the slides are available below: